Long-term investing is a strategy that involves holding assets for an extended period, typically years or even decades, to capitalize on the potential for growth and compounding returns. This approach contrasts sharply with short-term trading, which often focuses on quick gains and market timing. Long-term investors generally seek to benefit from the overall upward trajectory of the market, relying on the principle that, despite short-term fluctuations, the value of quality investments tends to increase over time.

This philosophy is rooted in the belief that economic fundamentals will prevail, allowing well-chosen assets to appreciate significantly. The essence of long-term investing lies in its focus on fundamental analysis rather than market sentiment. Investors who adopt this strategy often conduct thorough research into companies, industries, and economic indicators to identify undervalued assets with strong growth potential.

They understand that markets can be irrational in the short term, leading to price volatility that does not necessarily reflect a company’s true value. By maintaining a long-term perspective, investors can ride out these fluctuations and benefit from the compounding effect of reinvested dividends and capital gains over time.

The Benefits of Holding During Market Dips

One of the most significant advantages of long-term investing is the ability to weather market dips without panic selling. Historically, markets have experienced numerous downturns, but they have also shown a remarkable capacity for recovery. Investors who hold their positions during these turbulent times often find themselves in a better position when the market rebounds.

For instance, during the 2008 financial crisis, many investors who sold their stocks at the bottom missed out on the subsequent decade-long bull market that followed. Those who remained invested not only recovered their losses but also saw substantial gains as the market rebounded. Moreover, holding through market dips allows investors to take advantage of lower prices.

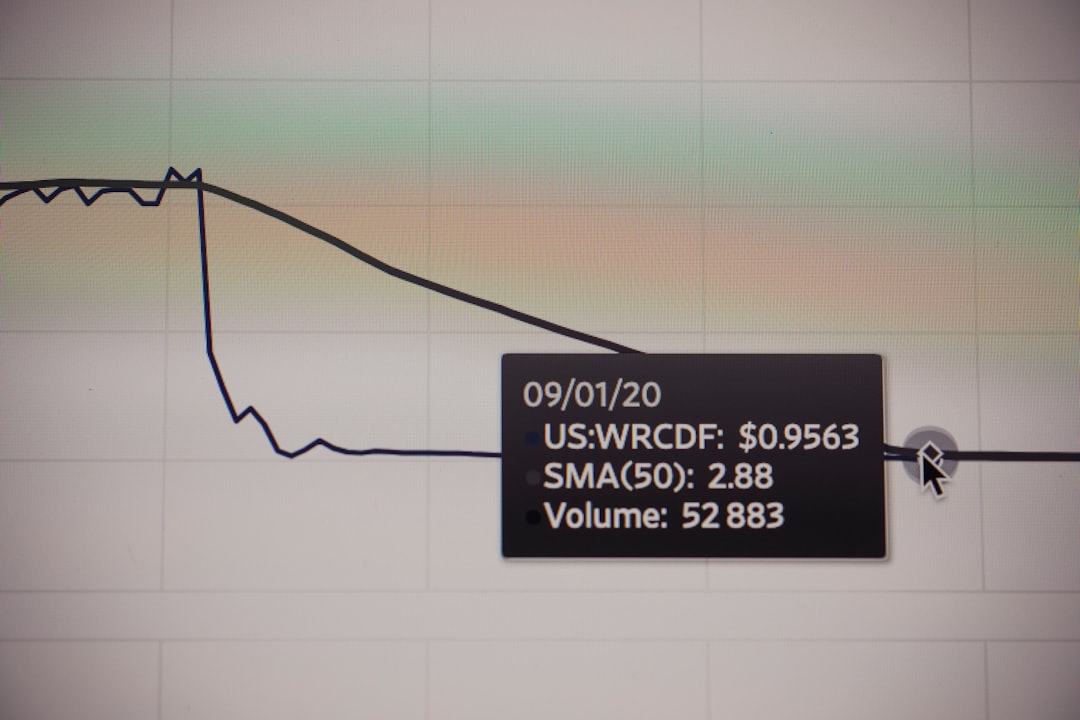

When stock prices decline, it creates opportunities to buy quality assets at a discount. This strategy is often referred to as “buying the dip.” For example, during the COVID-19 pandemic in early 2020, many stocks plummeted in value due to widespread uncertainty. Savvy long-term investors who recognized the temporary nature of the crisis seized the opportunity to purchase shares at significantly reduced prices.

As the economy began to recover, those investments yielded impressive returns, illustrating how patience and a long-term perspective can pay off.

Strategies for Success in Long-Term Investing

Successful long-term investing requires a well-thought-out strategy that aligns with an investor’s financial goals and risk tolerance. One effective approach is dollar-cost averaging, which involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy mitigates the impact of volatility by spreading out purchases over time, allowing investors to buy more shares when prices are low and fewer shares when prices are high.

Over time, this can lead to a lower average cost per share and reduce the emotional stress associated with trying to time the market. Another essential strategy is to focus on quality investments. Long-term investors should prioritize companies with strong fundamentals, such as solid earnings growth, robust cash flow, and competitive advantages within their industries.

These companies are more likely to withstand economic downturns and emerge stronger when conditions improve. Additionally, diversifying across various sectors and asset classes can help mitigate risk and enhance overall portfolio performance. By spreading investments across different industries and geographic regions, investors can reduce their exposure to any single economic event or market downturn.

Overcoming the Fear of Market Volatility

| Metrics | Data |

|---|---|

| Volatility Index | 20.45 |

| Investor Sentiment | Neutral |

| Historical Market Performance | Stable |

| Investment Strategy | Diversified Portfolio |

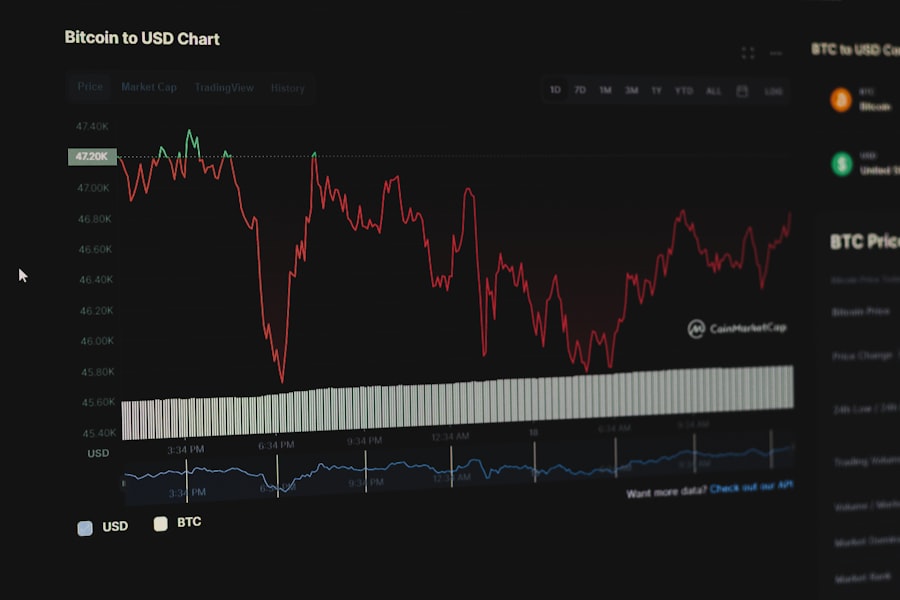

Market volatility can be daunting for many investors, often leading to anxiety and impulsive decision-making. However, understanding that volatility is a natural part of investing can help alleviate some of this fear. Historical data shows that markets experience fluctuations regularly; these ups and downs are often driven by factors such as economic indicators, geopolitical events, and changes in investor sentiment.

Recognizing that these fluctuations are temporary can empower investors to stay committed to their long-term strategies. To combat fear during turbulent times, investors can adopt a disciplined approach by setting clear investment goals and adhering to a well-defined plan. This includes establishing a target asset allocation based on individual risk tolerance and investment horizon.

By having a plan in place, investors can avoid making emotional decisions during periods of market stress. Additionally, seeking guidance from financial advisors or utilizing educational resources can provide valuable insights and reassurance during uncertain times.

The Importance of Patience in Long-Term Investing

Patience is perhaps one of the most critical virtues in long-term investing. The journey toward financial growth is rarely linear; it often involves periods of stagnation or decline interspersed with phases of rapid appreciation. Investors must be prepared for this reality and remain committed to their strategies even when progress seems slow or non-existent.

The power of compounding returns becomes evident over time; small gains can accumulate significantly when left to grow undisturbed. Moreover, patience allows investors to avoid the pitfalls of chasing trends or reacting impulsively to market noise. Many investors fall victim to the allure of quick profits and end up buying high and selling low—an approach that undermines long-term success.

By maintaining a patient mindset and focusing on their investment thesis, long-term investors can resist the temptation to make hasty decisions based on short-term market movements. This steadfastness ultimately leads to more favorable outcomes as they allow their investments the time needed to realize their full potential.

How to Identify Opportunities During Market Dips

Identifying opportunities during market dips requires a keen understanding of both individual assets and broader market trends. Investors should begin by conducting thorough research on companies they are interested in, analyzing their financial health, competitive positioning, and growth prospects. During a market downturn, it is crucial to differentiate between temporary setbacks and fundamental issues that may affect a company’s long-term viability.

For instance, if a company experiences a decline in stock price due to external factors like economic downturns or geopolitical tensions but maintains strong fundamentals, it may present an attractive buying opportunity. Additionally, keeping an eye on valuation metrics can help investors identify undervalued stocks during market dips. Common metrics include price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and dividend yields.

When these metrics indicate that a stock is trading below its historical averages or its intrinsic value, it may signal an opportunity for long-term investment. Furthermore, monitoring industry trends and macroeconomic indicators can provide insights into sectors poised for recovery or growth after a downturn.

Building a Diversified Portfolio for Long-Term Success

A diversified portfolio is essential for mitigating risk and enhancing potential returns over the long term. Diversification involves spreading investments across various asset classes—such as stocks, bonds, real estate, and commodities—as well as different sectors within those classes. This strategy helps reduce exposure to any single investment’s poor performance while allowing investors to benefit from multiple sources of return.

When constructing a diversified portfolio, investors should consider their risk tolerance and investment objectives. For example, younger investors with a longer time horizon may opt for a higher allocation to equities for growth potential, while those nearing retirement might prioritize fixed-income securities for stability and income generation. Additionally, geographic diversification can further enhance portfolio resilience by reducing exposure to localized economic downturns.

Investing in international markets can provide access to growth opportunities outside one’s home country while balancing risks associated with domestic economic fluctuations.

Staying Informed and Adapting to Market Changes

In the ever-evolving landscape of investing, staying informed is crucial for long-term success. Investors should regularly monitor economic indicators, industry trends, and company news that may impact their portfolios. Subscribing to reputable financial news sources, attending webinars or conferences, and engaging with investment communities can provide valuable insights into market dynamics.

Moreover, adaptability is key in long-term investing. While maintaining a core investment strategy is essential, being open to adjusting one’s approach based on changing market conditions or new information is equally important. For instance, if an investor identifies emerging technologies or shifts in consumer behavior that could disrupt traditional industries, they may choose to reallocate funds toward more promising sectors.

This proactive approach ensures that investors remain aligned with their long-term goals while capitalizing on new opportunities as they arise. In conclusion, long-term investing is not merely about selecting assets; it encompasses a comprehensive understanding of market dynamics, emotional resilience during volatility, strategic planning for success, and ongoing education about evolving trends. By embracing these principles and maintaining a patient mindset, investors can navigate the complexities of the financial markets while positioning themselves for sustainable growth over time.

FAQs

What is long-term investing?

Long-term investing refers to the strategy of holding onto investments for an extended period, typically five years or more, with the goal of achieving long-term financial growth.

What is the power of holding during dips in the market?

The power of holding during dips in the market refers to the ability of long-term investors to withstand short-term market fluctuations and benefit from the potential for higher returns over time.

Why is holding during dips important for long-term investors?

Holding during dips is important for long-term investors because it allows them to avoid making impulsive decisions based on short-term market movements and instead stay focused on their long-term investment goals.

What are some benefits of holding during market dips?

Benefits of holding during market dips include the potential for buying assets at lower prices, taking advantage of market recovery, and avoiding the costs and risks associated with frequent trading.

What are some strategies for holding during market dips?

Strategies for holding during market dips include maintaining a diversified portfolio, staying informed about market trends, and having a long-term investment plan in place to help weather market volatility.