The mutual fund paradox presents a perplexing scenario in the world of investing, where investors often find themselves in a situation that seems counterintuitive. Despite the overall growth of the market, many mutual fund investors experience disappointing returns, leading to frustration and confusion. This paradox raises critical questions about the efficacy of mutual funds as an investment vehicle, particularly in a landscape where market indices are on the rise.

The phenomenon is not merely anecdotal; it is supported by empirical data that reveals a significant disconnect between market performance and investor outcomes. At its core, the mutual fund paradox challenges the conventional wisdom that investing in mutual funds is a surefire way to capitalize on market growth. While mutual funds are designed to pool resources from multiple investors to achieve diversified exposure to various asset classes, the reality is that many investors fail to realize the anticipated benefits.

This article delves into the intricacies of this paradox, exploring the dynamics of the growing market, the role of mutual funds, and the factors that contribute to this dissonance between market performance and investor returns.

Understanding the Growing Market

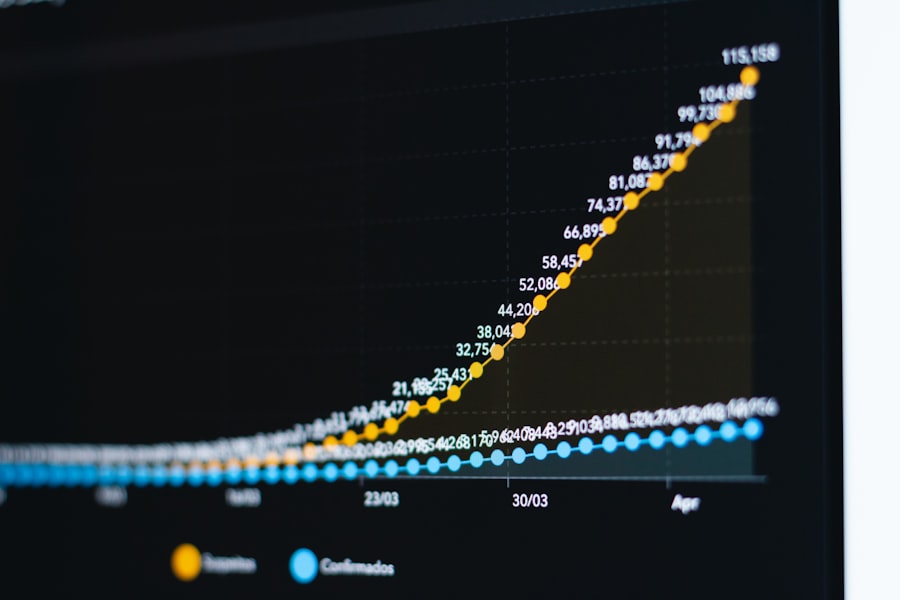

To comprehend the mutual fund paradox, one must first understand the broader context of the financial markets. Over the past few decades, global equity markets have experienced substantial growth, driven by technological advancements, globalization, and favorable monetary policies. For instance, the S&P 500 index has seen remarkable gains, with periods of significant bull markets that have led to record highs.

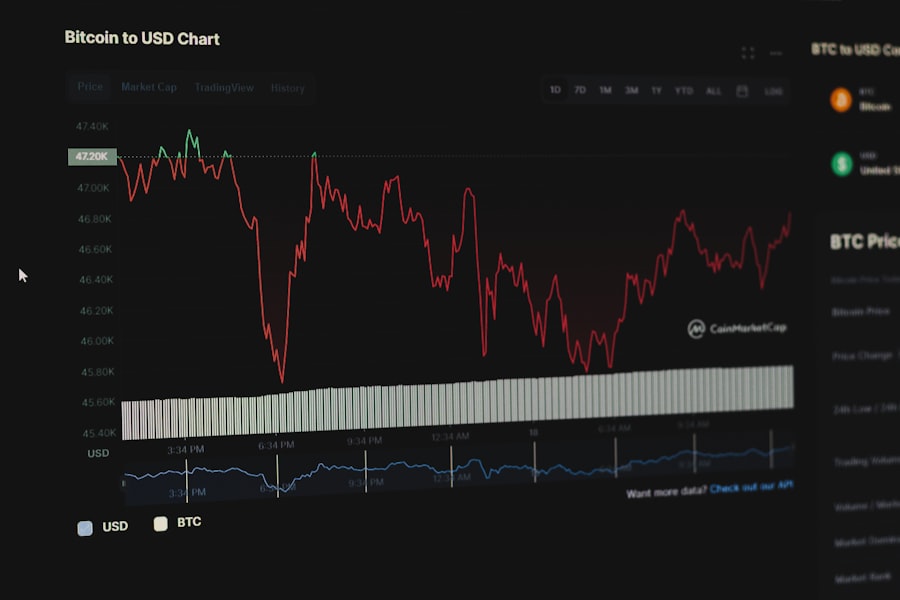

This growth has been fueled by a combination of factors, including low interest rates, increased consumer spending, and corporate profitability. However, while the overall market may be thriving, individual investors often find themselves grappling with underwhelming returns from their mutual fund investments. This discrepancy can be attributed to several factors, including timing, market volatility, and investor behavior.

Many investors tend to buy into mutual funds during periods of high performance, only to sell during downturns, which can lead to suboptimal investment outcomes. Understanding these dynamics is crucial for investors seeking to navigate the complexities of mutual fund investing in a growing market.

Exploring the Role of Mutual Funds

Mutual funds serve as a popular investment vehicle for both novice and experienced investors alike. They offer a range of benefits, including diversification, professional management, and accessibility. By pooling capital from multiple investors, mutual funds can invest in a broad array of securities, thereby reducing individual risk exposure.

This diversification is particularly appealing in volatile markets, where individual stocks may experience significant fluctuations. Moreover, mutual funds are managed by professional portfolio managers who possess expertise in selecting securities and making investment decisions. This professional oversight can be advantageous for investors who may lack the time or knowledge to manage their portfolios effectively.

Additionally, mutual funds provide liquidity, allowing investors to buy or sell shares on any business day at the net asset value (NAV). Despite these advantages, the mutual fund structure is not without its drawbacks, which contribute to the paradox of losing money in a growing market.

The Paradox: Losing Money in a Growing Market

| Year | Market Growth Rate | Company Revenue | Profit/Loss |

|---|---|---|---|

| 2018 | 5% | 10,000,000 | -500,000 |

| 2019 | 8% | 12,000,000 | -300,000 |

| 2020 | 10% | 15,000,000 | -100,000 |

| 2021 | 12% | 18,000,000 | -50,000 |

The mutual fund paradox becomes particularly evident when examining investor returns relative to market performance. Even in a rising market, many mutual fund investors find themselves with disappointing results. This phenomenon can be attributed to several factors that influence investor behavior and decision-making processes.

For instance, studies have shown that investors often exhibit a tendency to chase performance, buying into funds that have recently outperformed their peers while neglecting those that may have underperformed but possess strong long-term potential. This behavior can lead to a cycle of buying high and selling low, which is detrimental to overall investment performance. Additionally, mutual funds often come with fees and expenses that can erode returns over time.

These costs include management fees, administrative expenses, and sales loads, which can significantly impact net returns for investors. As a result, even if a mutual fund is invested in a growing market, high fees can diminish the benefits of that growth for individual investors.

Factors Contributing to the Mutual Fund Paradox

Several factors contribute to the mutual fund paradox, complicating the relationship between market growth and investor returns. One significant factor is market timing. Many investors attempt to time their investments based on perceived market trends or economic indicators.

However, accurately predicting market movements is notoriously difficult, and those who try often find themselves on the wrong side of their decisions. This misalignment can lead to missed opportunities during periods of growth or losses during downturns. Another contributing factor is behavioral finance—specifically, emotional decision-making that can cloud judgment.

Investors may react impulsively to market fluctuations or news events, leading them to make hasty decisions that are not aligned with their long-term investment goals. For example, during periods of market volatility or economic uncertainty, fear may drive investors to sell their holdings at inopportune times. This behavior not only undermines potential gains but also exacerbates the mutual fund paradox by locking in losses when they could have otherwise benefited from market recovery.

Strategies for Overcoming the Mutual Fund Paradox

To navigate the complexities of the mutual fund paradox effectively, investors must adopt strategies that promote disciplined investing and long-term thinking. One essential strategy is to establish clear investment goals and adhere to a well-defined investment plan. By setting specific objectives—such as retirement savings or funding education—investors can maintain focus on their long-term aspirations rather than being swayed by short-term market fluctuations.

Additionally, dollar-cost averaging can be an effective approach for mitigating the impact of market volatility. This strategy involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. By doing so, investors can reduce the risk of making poor timing decisions and benefit from purchasing more shares when prices are low and fewer shares when prices are high.

Furthermore, conducting thorough research on mutual funds before investing is crucial. Investors should evaluate factors such as historical performance, expense ratios, and manager tenure to make informed decisions about which funds align with their investment objectives. By focusing on funds with strong fundamentals and a consistent track record rather than chasing recent performance trends, investors can enhance their chances of achieving favorable outcomes.

Alternative Investment Options

While mutual funds remain a popular choice for many investors, exploring alternative investment options can provide additional avenues for achieving financial goals. Exchange-traded funds (ETFs) have gained traction as an alternative due to their lower expense ratios and greater flexibility compared to traditional mutual funds. ETFs trade on stock exchanges like individual stocks and offer diversification across various asset classes while typically incurring lower fees.

Real estate investment trusts (REITs) represent another alternative for those seeking income-generating investments outside traditional equities. REITs allow investors to gain exposure to real estate markets without directly owning properties while providing potential dividends from rental income. Additionally, direct investments in real estate or crowdfunding platforms can offer unique opportunities for diversification and potential returns.

For those willing to take on more risk for potentially higher rewards, venture capital or private equity investments may be appealing options. These investments typically involve funding startups or private companies with high growth potential but come with increased risk and illiquidity compared to more traditional investments.

Conclusion and Key Takeaways

The mutual fund paradox serves as a reminder that investing is not merely about selecting popular vehicles but requires a nuanced understanding of market dynamics and investor behavior. While mutual funds offer numerous advantages such as diversification and professional management, they are not immune to challenges that can hinder investor returns even in favorable market conditions. By recognizing the factors contributing to this paradox—such as market timing issues and behavioral biases—investors can adopt strategies that promote disciplined investing and long-term success.

Exploring alternative investment options further expands opportunities for achieving financial goals while mitigating risks associated with traditional mutual fund investing. Ultimately, navigating the complexities of investing requires continuous education and adaptability in an ever-evolving financial landscape. By remaining informed and proactive in their investment strategies, individuals can work towards overcoming the mutual fund paradox and achieving their desired financial outcomes.

FAQs

What are mutual funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

Why do people lose money in mutual funds despite market growth?

There are several reasons why people may lose money in mutual funds despite market growth, including high fees, poor fund selection, market timing, and emotional decision-making.

How do high fees impact mutual fund returns?

High fees can significantly erode the returns of a mutual fund, especially over the long term. This can result in investors losing money even when the overall market is growing.

What is poor fund selection and how does it impact returns?

Poor fund selection refers to choosing mutual funds that consistently underperform their benchmarks or have high expenses. This can lead to subpar returns and potential losses for investors.

What is market timing and why is it a risky strategy?

Market timing involves trying to predict the future movements of the market in order to buy and sell mutual funds at the most opportune times. This strategy is risky because it is difficult to consistently make accurate predictions about market movements.

How does emotional decision-making impact mutual fund investments?

Emotional decision-making, such as panic selling during market downturns or chasing performance during market upswings, can lead to poor investment outcomes and potential losses in mutual funds.