Investing in US stocks from India has become increasingly accessible, thanks to advancements in technology and the globalization of financial markets. The allure of the US stock market lies in its vast array of investment opportunities, including some of the world’s most renowned companies like Apple, Amazon, and Google. For Indian investors, the prospect of diversifying their portfolios by including international stocks can be particularly appealing, as it allows them to hedge against local market volatility and currency fluctuations.

However, before diving into this investment avenue, it is crucial to grasp the fundamental concepts of stock investing, including how stock markets operate, the types of stocks available, and the factors influencing stock prices. Understanding the mechanics of stock trading is essential for any investor. Stocks represent ownership in a company, and their prices fluctuate based on supply and demand dynamics in the market.

Investors can buy shares through brokerage accounts, which act as intermediaries between buyers and sellers. In the US market, stocks are traded on various exchanges, with the New York Stock Exchange (NYSE) and the Nasdaq being the most prominent. Investors should familiarize themselves with key terms such as market capitalization, earnings per share (EPS), price-to-earnings (P/E) ratio, and dividends, as these metrics play a significant role in evaluating potential investments.

Additionally, keeping abreast of economic indicators, corporate earnings reports, and geopolitical events can provide valuable insights into market trends.

Choosing the Right Brokerage Platform for Investing in US Stocks

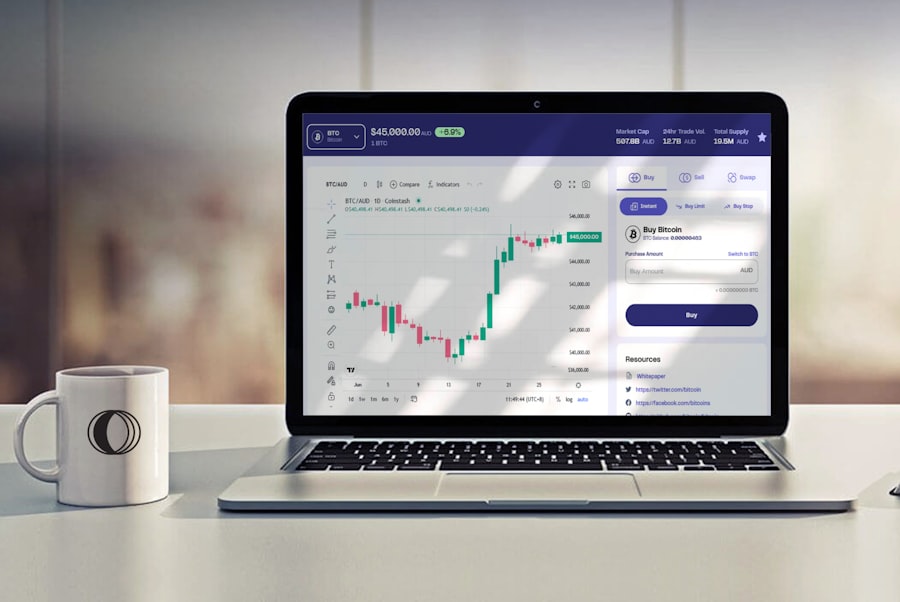

Selecting an appropriate brokerage platform is a critical step for Indian investors looking to invest in US stocks. Numerous online brokerage firms cater to international investors, each offering a unique set of features, fees, and services. When evaluating brokerage options, it is essential to consider factors such as trading commissions, account minimums, user interface, research tools, and customer support.

Some popular platforms include Interactive Brokers, Charles Schwab, and TD Ameritrade, which provide access to a wide range of US stocks and ETFs. In addition to traditional brokerage firms, several fintech companies have emerged in recent years that specifically target Indian investors interested in US markets. These platforms often offer lower fees and user-friendly interfaces designed for novice investors.

For instance, platforms like Groww and Paytm Money have introduced features that allow users to invest in US stocks with minimal hassle. It is also important to assess whether the brokerage provides educational resources and research tools that can aid in making informed investment decisions. Ultimately, the right brokerage platform should align with an investor’s individual needs and investment goals while providing a seamless trading experience.

Researching and Selecting the Right US Stocks to Invest In

Once an investor has chosen a brokerage platform, the next step is to research and select specific US stocks to invest in. This process involves analyzing various factors that can influence a company’s performance and stock price. Fundamental analysis is a common approach that focuses on evaluating a company’s financial health by examining its balance sheet, income statement, and cash flow statement.

Key metrics such as revenue growth, profit margins, return on equity (ROE), and debt-to-equity ratio can provide insights into a company’s operational efficiency and overall stability. In addition to fundamental analysis, technical analysis can also be employed to identify potential entry and exit points for investments. This method involves studying historical price movements and trading volumes to forecast future price trends.

Investors may utilize chart patterns, moving averages, and various technical indicators to make informed decisions. Furthermore, staying updated on industry trends and news can help investors identify emerging sectors or companies poised for growth. For instance, sectors like technology and renewable energy have garnered significant attention due to their potential for innovation and expansion.

Understanding the Risks and Benefits of Investing in US Stocks from India

| Metrics | Description |

|---|---|

| Return on Investment | The potential profit or loss from investing in US stocks. |

| Volatility | The degree of variation of a trading price series over time. |

| Exchange Rate Risk | The risk of fluctuations in exchange rates affecting investment returns. |

| Regulatory Risks | The potential impact of changes in regulations on US stocks. |

| Liquidity | The ease of buying and selling US stocks in the market. |

| Tax Implications | The tax treatment of investment returns from US stocks in India. |

Investing in US stocks from India presents both opportunities and risks that investors must carefully consider. One of the primary benefits is diversification; by investing in international markets, Indian investors can reduce their exposure to domestic economic fluctuations. The US stock market is known for its liquidity and depth, providing investors with a wide range of options across various sectors.

Additionally, many US companies have established global operations, which can lead to more stable revenue streams compared to companies that operate solely within India. However, investing in US stocks also comes with inherent risks. Currency risk is one of the most significant factors; fluctuations in the exchange rate between the Indian Rupee (INR) and the US Dollar (USD) can impact investment returns.

For example, if an investor’s stock appreciates in value but the INR weakens against the USD during the investment period, the overall return may be diminished when converted back to INR. Moreover, geopolitical tensions or changes in US economic policy can affect market sentiment and stock prices. Investors must also be aware of regulatory risks associated with foreign investments and ensure compliance with both Indian and US laws.

Navigating the Legal and Regulatory Considerations for Investing in US Stocks from India

Investing in US stocks from India involves navigating a complex landscape of legal and regulatory considerations. The Reserve Bank of India (RBI) governs foreign investments through its Liberalized Remittance Scheme (LRS), which allows Indian residents to remit up to a certain amount annually for investments abroad. As of 2023, this limit stands at $250,000 per financial year.

Investors must ensure that they adhere to this limit when transferring funds for stock purchases. Additionally, it is essential for investors to understand tax implications associated with investing in foreign stocks. The United States imposes a withholding tax on dividends paid to foreign investors, which is typically set at 30%.

However, India has a Double Taxation Avoidance Agreement (DTAA) with the US that may allow Indian investors to claim a reduced withholding tax rate under certain conditions. Furthermore, Indian investors are required to report their foreign investments in their income tax returns and may be subject to capital gains tax upon selling their US stocks. Consulting with a tax advisor who specializes in international investments can help navigate these complexities effectively.

Managing Currency Exchange and Tax Implications of Investing in US Stocks from India

Currency exchange management is a crucial aspect of investing in US stocks from India. When converting INR to USD for investment purposes, investors must be mindful of exchange rates offered by banks or currency exchange platforms. Fluctuations in exchange rates can significantly impact the total cost of investment as well as returns upon selling shares.

Some investors may choose to use forward contracts or options to hedge against currency risk; however, these strategies require a deeper understanding of financial instruments. Tax implications also play a vital role in shaping an investor’s overall strategy when investing abroad. As mentioned earlier, understanding withholding taxes on dividends is essential for accurate financial planning.

Additionally, capital gains tax rates differ based on whether gains are classified as short-term or long-term; typically, long-term capital gains are taxed at lower rates than short-term gains. Investors should maintain detailed records of their transactions to facilitate accurate reporting during tax season. Engaging with financial professionals who specialize in cross-border taxation can provide valuable insights into optimizing tax liabilities while ensuring compliance with regulations.

Developing a Long-Term Investment Strategy for US Stocks from India

Creating a long-term investment strategy is fundamental for Indian investors looking to build wealth through US stocks. A well-defined strategy should encompass an investor’s financial goals, risk tolerance, time horizon, and asset allocation preferences. For instance, younger investors with a longer time horizon may opt for growth-oriented stocks that have higher volatility but offer substantial upside potential over time.

Conversely, more conservative investors nearing retirement might prioritize dividend-paying stocks or blue-chip companies known for stability. Diversification is another key component of a robust investment strategy. By spreading investments across various sectors and asset classes—such as equities, ETFs, or mutual funds—investors can mitigate risks associated with individual stock performance.

Regularly rebalancing the portfolio ensures that it remains aligned with an investor’s risk tolerance and market conditions. Additionally, setting up automatic contributions to investment accounts can help maintain discipline while taking advantage of dollar-cost averaging—a strategy that involves investing fixed amounts at regular intervals regardless of market conditions.

Monitoring and Evaluating Your US Stock Investments from India

Monitoring and evaluating investments is an ongoing process that requires diligence and adaptability. Investors should regularly review their portfolios to assess performance against benchmarks or indices relevant to their investment strategy. This evaluation process involves analyzing not only stock price movements but also broader market trends and economic indicators that could impact future performance.

Staying informed about company-specific news—such as earnings reports, product launches, or management changes—is equally important for making timely decisions regarding buying or selling stocks. Many brokerage platforms offer tools for tracking performance metrics and setting alerts for significant price changes or news events related to specific investments. Engaging with financial news sources or investment communities can also provide valuable insights into market sentiment and emerging trends that may influence investment strategies over time.

In conclusion, investing in US stocks from India presents both opportunities for growth and challenges that require careful consideration. By understanding the basics of investing, choosing the right brokerage platform, conducting thorough research on potential investments, navigating legal considerations, managing currency risks and tax implications, developing a long-term strategy, and continuously monitoring investments, Indian investors can effectively participate in one of the world’s largest financial markets while working towards their financial goals.

FAQs

What are the requirements for an Indian to start investing in US stocks?

To start investing in US stocks from India, you will need to have a PAN card, a valid passport, and a valid visa for the US. Additionally, you will need to open a trading and demat account with a registered broker in India who offers the facility to invest in US stocks.

What are the options for investing in US stocks from India?

Indian investors can invest in US stocks through various routes such as direct investment through a broker, mutual funds that invest in US stocks, or through exchange-traded funds (ETFs) that track US stock indices.

What are the tax implications for Indian investors investing in US stocks?

Indian investors investing in US stocks are subject to taxation in both countries. They may be required to pay taxes on capital gains, dividends, and any other income earned from their US stock investments. It is advisable to consult a tax advisor to understand the tax implications.

What are the risks associated with investing in US stocks from India?

Investing in US stocks from India carries certain risks such as currency exchange rate fluctuations, geopolitical risks, and regulatory risks. Additionally, the performance of US stocks can be influenced by global economic conditions and market volatility.

How can an Indian investor stay updated with the US stock market?

Indian investors can stay updated with the US stock market by following financial news websites, subscribing to market analysis reports, and using mobile applications that provide real-time stock market data. Additionally, they can also follow US stock market indices and individual stock prices through various financial platforms.