Budgeting is often heralded as the cornerstone of financial health, yet many individuals find themselves ensnared in a web of common pitfalls that can derail their efforts. The act of budgeting is not merely about tracking income and expenses; it requires a nuanced understanding of one’s financial landscape, including spending habits, income fluctuations, and personal goals. Many people approach budgeting with enthusiasm, only to become disheartened when they encounter obstacles such as unexpected expenses or a lack of discipline.

Recognizing these pitfalls is the first step toward creating a sustainable budgeting strategy that can withstand the test of time. One prevalent pitfall is the tendency to create overly ambitious budgets that do not reflect reality. Individuals often underestimate their discretionary spending or fail to account for irregular expenses, leading to frustration and a sense of failure when they inevitably overspend.

Additionally, emotional spending can complicate budgeting efforts, as individuals may turn to shopping or dining out as a means of coping with stress or boredom. Understanding these common challenges is essential for anyone looking to establish a successful budgeting plan that not only tracks finances but also aligns with personal values and lifestyle choices.

Identifying Your Spending Habits and Patterns

Before embarking on the journey of budgeting, it is crucial to take a step back and analyze your spending habits and patterns. This process involves a thorough examination of where your money goes each month, which can reveal surprising insights. For instance, many individuals may not realize how much they spend on small, seemingly inconsequential purchases, such as coffee or snacks.

These expenditures can accumulate significantly over time, impacting overall financial health. By categorizing spending into fixed expenses, variable expenses, and discretionary spending, individuals can gain clarity on their financial behaviors. Tracking spending over a few months can provide a clearer picture of patterns that may not be immediately apparent.

For example, you might discover that you consistently overspend on entertainment during certain months or that your grocery bills spike during specific seasons. This awareness allows for more informed decision-making when it comes to budgeting. Additionally, reflecting on emotional triggers that lead to impulsive purchases can help individuals develop strategies to mitigate these behaviors.

By understanding the underlying motivations behind spending habits, one can create a more tailored and effective budget.

Creating a Realistic and Flexible Budget

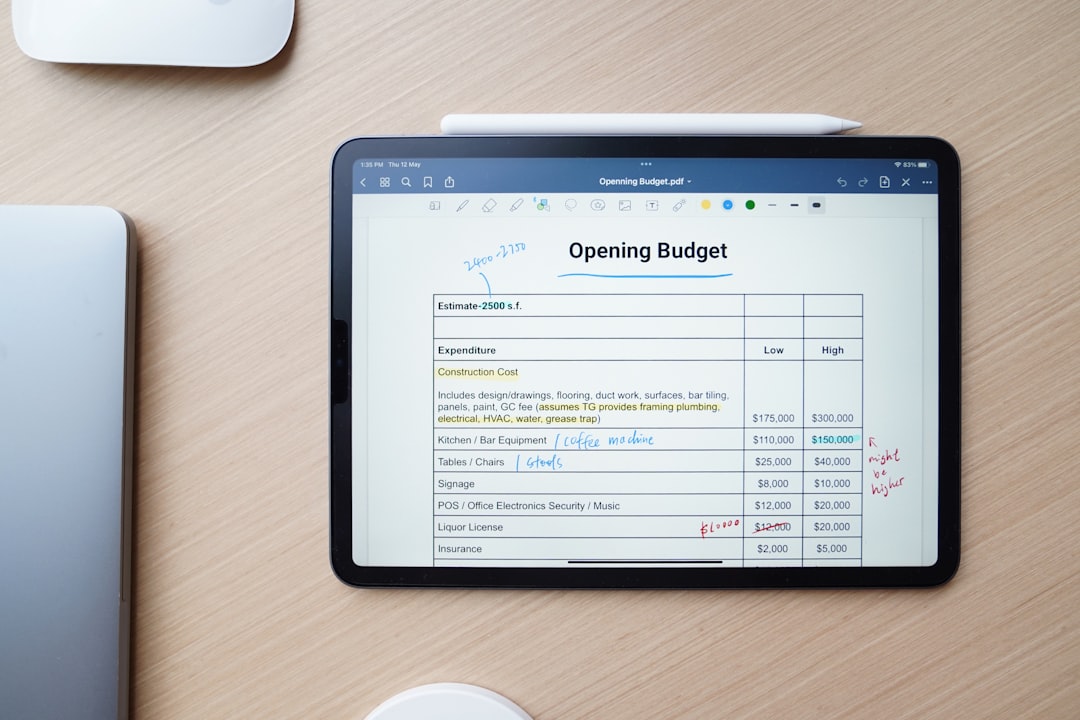

Once you have identified your spending habits, the next step is to create a budget that is both realistic and flexible. A budget should serve as a roadmap for your financial journey, guiding you toward your goals while accommodating the inevitable fluctuations in income and expenses. To achieve this balance, it is essential to set realistic limits based on historical spending patterns rather than idealized versions of what you think you should spend.

This approach fosters a sense of ownership over your budget and reduces the likelihood of feeling deprived or restricted. Flexibility is another critical component of an effective budget. Life is unpredictable; unexpected expenses can arise at any moment, whether it’s a car repair or a medical bill.

A rigid budget that does not allow for adjustments can lead to frustration and feelings of failure when these situations occur. Incorporating a buffer into your budget for unforeseen expenses can provide peace of mind and help maintain financial stability. Additionally, regularly reviewing and adjusting your budget based on changing circumstances—such as a new job or relocation—ensures that it remains relevant and effective.

Setting Clear Financial Goals and Priorities

| Financial Goals | Priorities |

|---|---|

| Save for retirement | High |

| Pay off high-interest debt | Medium |

| Build emergency fund | High |

| Invest in education | Low |

Establishing clear financial goals is paramount in guiding your budgeting efforts. Goals provide direction and motivation, helping you stay focused on what truly matters to you. Whether your objectives include saving for a home, paying off debt, or building an emergency fund, defining these goals allows you to allocate resources effectively.

It’s important to differentiate between short-term and long-term goals; short-term goals might include saving for a vacation, while long-term goals could involve retirement planning or funding education. Prioritizing these goals is equally important, as it helps you make informed decisions about where to allocate your funds. For instance, if paying off high-interest debt is a priority, you may need to adjust discretionary spending in other areas temporarily.

This prioritization process requires honest reflection on what matters most to you and may involve trade-offs. By aligning your budget with your financial goals and priorities, you create a sense of purpose that can enhance your commitment to sticking with your budget over time.

Utilizing Budgeting Tools and Apps

In today’s digital age, numerous budgeting tools and apps are available to simplify the budgeting process and enhance financial management. These tools can help automate tracking expenses, categorize spending, and provide insights into financial habits through visual representations like graphs and charts. For example, apps like Mint or YNAB (You Need A Budget) allow users to link their bank accounts directly, providing real-time updates on spending and helping users stay within their budgetary limits.

Moreover, many budgeting tools offer features that facilitate goal setting and progress tracking. Users can set specific savings targets and receive notifications when they are nearing their limits in various categories. This level of engagement can foster accountability and encourage users to make more informed financial decisions.

However, it’s essential to choose a tool that aligns with your personal preferences and comfort level with technology; some individuals may prefer traditional spreadsheets while others thrive with mobile applications.

Finding Ways to Increase Income or Decrease Expenses

While creating a budget is crucial for managing finances effectively, it’s equally important to explore ways to increase income or decrease expenses. Increasing income can take various forms, from seeking a raise at work to exploring side hustles or freelance opportunities. For instance, individuals with skills in writing, graphic design, or programming may find lucrative freelance gigs that not only supplement their income but also provide valuable experience in their fields.

On the other hand, decreasing expenses often requires a more critical examination of current spending habits. This could involve negotiating bills such as insurance or cable services for better rates or cutting back on non-essential subscriptions that may have accumulated over time. Additionally, adopting frugal habits—such as meal planning to reduce grocery costs or utilizing public transportation instead of driving—can lead to significant savings over time.

By actively seeking ways to enhance income while minimizing expenses, individuals can create a more robust financial foundation that supports their budgeting efforts.

Staying Accountable and Consistent with Your Budget

Accountability plays a vital role in maintaining consistency with your budget. Establishing regular check-ins—whether weekly or monthly—can help you assess your progress toward financial goals and identify areas where adjustments may be necessary. During these check-ins, reviewing spending patterns against your budget allows for reflection on successes and challenges alike.

This practice not only reinforces commitment but also fosters a sense of responsibility for one’s financial choices. In addition to self-accountability, involving others in your budgeting journey can provide additional motivation and support. Sharing your goals with family members or friends can create an environment of encouragement where everyone holds each other accountable for their financial decisions.

Some individuals may even find success in joining budgeting groups or online communities where they can share experiences and strategies with like-minded individuals. This sense of community can be invaluable in maintaining motivation and consistency over time.

Seeking Professional Help and Guidance if Needed

For some individuals, navigating the complexities of budgeting may feel overwhelming or unmanageable. In such cases, seeking professional help from financial advisors or counselors can provide valuable guidance tailored to individual circumstances. Financial professionals can offer insights into effective budgeting strategies, investment opportunities, and debt management techniques that align with personal goals.

Moreover, engaging with professionals can help demystify aspects of personal finance that may seem daunting—such as tax planning or retirement savings strategies—allowing individuals to make informed decisions about their financial futures. While there may be costs associated with hiring a financial advisor, the potential benefits in terms of improved financial literacy and long-term savings can far outweigh these initial investments. Ultimately, recognizing when professional assistance is needed is an important step toward achieving financial stability and success in budgeting efforts.

FAQs

What are common reasons why budgets fail every month?

Some common reasons why budgets fail every month include underestimating expenses, overspending, not tracking expenses, and unexpected financial emergencies.

How can I fix my budget if it fails every month?

To fix a failing budget, you can start by tracking your expenses, creating a realistic budget, cutting unnecessary expenses, increasing your income, and building an emergency fund.

What are some tips for creating a successful budget?

Some tips for creating a successful budget include tracking your expenses, setting realistic financial goals, prioritizing your spending, creating a buffer for unexpected expenses, and regularly reviewing and adjusting your budget.

Why is it important to have a successful budget?

Having a successful budget is important because it helps you manage your finances, achieve your financial goals, reduce financial stress, and build a secure financial future.